Most Americans don’t have a financial advisor. Just 35% worked with these specialists in 2022.

The same year, nearly half of Americans had $0 in retirement savings, though, so we can’t necessarily trust the wisdom of the crowd on this one.

The question is, what’s right for you?

Some people get tremendous benefits from collaborating with financial professionals. Others don’t. After all, these services cost money. If you’re not at a certain point along your financial journey—and we’ll explain the milestones later in this article—paying a financial advisor is probably not worth it.

That might seem like a funny thing for us, a bunch of financial advisors, to say. But we’re not just wealth managers. We’re also fiduciaries. That means we’re legally obligated to act in your best interest (which is nice, since it’s what we want to do, anyway).

If we can’t provide more value than you’d pay in fees, we’ll tell you that—and recommend a course of action that gets you closer to your goals, with or without us.

So how do you know if financial advisors are worth the money for you, at this unique moment in your unique life? Our answers to these frequently asked questions can help you decide.

Find out if a financial advisor’s right for you with a free consultation, no strings attached. Contact Curio Wealth today.

When are financial advisors worth the money?

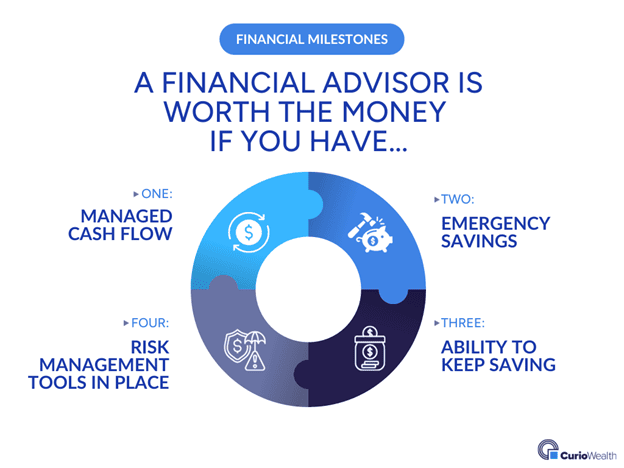

A financial advisor is almost always “worth the money” if you have four things in place. These are the milestones we mentioned earlier, four foundations of financial life that lay the basis for a strong lifetime wealth plan:

- Managed cash flow. First off, you need an income that outmatches your spending. You must figure out how to keep this income flowing regularly, ideally with some measure of predictability.

- Emergency savings. Life is unpredictable. Your emergency savings provide a cash cushion to keep you out of debt. Aim for three to six months’ worth of expenses.

- Ability to keep saving. This goes back to making more than you spend. If you can’t save, there’s not a lot to work with, and your best bet is to revisit the first item on this list.

- Risk management tools in place. There’s no point in growing your wealth if it’s over-exposed to hazards. Insurance helps manage some risk. Certain strategies for investing, saving, handling debts, and paying taxes do, too.

If you’ve checked these items off your list, financial advisors can help you take your next steps. If not, we’ll probably recommend working on these before starting (and paying for) an ongoing advising relationship.

That doesn’t mean you shouldn’t visit a fiduciary with questions, though!

It’s always worth a call. Whether on a one-time basis or an ongoing basis, we can give you an objective assessment whether you’re just starting out or nearing retirement.

Even in a free discovery call, we’ll send you away with resources and helpful ideas to keep moving toward your financial goals. And if that involves more consultation, we’ll set that up, too.

When is paying a financial advisor not worth it?

What we have found over the years is that if you don’t have the four pillars of financial stability in place, our fees may not necessarily be the best use of your money. While you are working to build your savings, manage cash flow, and manage risk, your resources should usually be dedicated towards those objectives.

Oftentimes, hiring a financial advisor can sound like the best thing to do; but in these situations it can be a form of procrastination masked as productivity. We want you to reach your goals, and if it looks like our services might not be the best way to make progress at that time, we will be the first to tell you.

You also might not benefit from ongoing investment advisory services if your savings are all in a workplace retirement plan. While we can help you make choices within that framework, our options are limited by this savings structure.

The only other time we’d say financial advisors aren’t worth the money, however, is when you choose the wrong partner. We’ll explain more about that in the last question on this FAQ.

What exactly does a financial advisor do, anyway?

This misunderstanding stems from a basic category error. We think of our financial lives as somehow separate from our “real” lives—our interests, our relationships, our values .

A good financial advisor breaks down this imaginary barrier. We don’t just get your financial life in order; we order your finances to fit your life. We’re here to help you align your finances with what’s most important to you.

Investments are part of your personalized financial plan, the living, changing product of your collaboration with an advisor. But they’re a small part of what CERTIFIED FINANCIAL PLANNER® and New York Times columnist Carl Richards calls your “complete financial life.” That also includes assets, income, insurance, estate plans, debt, and all the uses to which you put these tools.

A good financial planner starts by understanding your goals.

- Are you saving to send your kids to college?

- Planning for early retirement?

- Confused about an inheritance?

- Laying a foundation for future financial growth?

At Curio Wealth, we meet you wherever you are. We work to understand your goals, in terms both long and short. We come up with a plan to bring those goals to fruition. Finally, we help you execute the plan—even when temporary market fluctuations tempt you away from the path.

If we can stick with the “financial journey” metaphor, think of your financial advisor as a guide. We know the territory, and we can steer you away from ditches. And there’s plenty of evidence to show that, without experienced guidance, investors fall into the same ditches again and again.

Financial Advisors and Managing the Behavior Gap

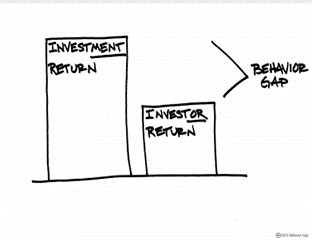

Look at investments, for example. Every year, a market research firm called DALBAR compares the performance of the market to that of individual investors. Markets almost always outperform investors. In 2022, investors lost 3.06% more than the market as a whole.

Investor behavior accounts for this difference, which is why experienced professionals call it the behavior gap. Chasing gains and fleeing losses according to common sense, not the weird logic of markets, ends in underperformance.

Financial advisors shrink that behavior gap. Our coaching often helps clients get higher returns on their investments—and we bring the same experience to other financial challenges, like minimizing taxes, outpacing inflation, and controlling risk.

How do financial advisors get paid?

Every financial advisor falls somewhere on a business-model spectrum. On one end, you have fee-only fiduciaries. (That’s how Curio Wealth operates.) These professionals charge you, the client, on a per-service basis or as a percentage of managed assets.

On the other end, you have commission-based advisors. They get paid by the companies that make the products they sell—mutual funds, annuities, insurance, etc.

Great, you might think. I can go to a commission-based financial advisor and get services for free. The trouble is that an advisor who’s paid to re-sell a product will always have the same advice: Buy this product.

Fee-based, fiduciary advisors are more likely to help you reach your financial goals. But a business model based on third-party commissions isn’t the only red flag to look out for while you search for a financial advisor.

How can you tell if a financial advisor will not be worth it?

Not all financial advisors are fiduciaries. Remember, that’s a legal designation for a service provider who’s obligated to serve the client’s best interests, not their own bottom line. So we’d recommend avoiding non-fiduciary service providers.

You can’t operate as a fiduciary if you sell financial products, so sticking with fiduciaries like Curio Wealth will also weed out commission-based sellers.

Credentials also matter. Choose advisors with the CERTIFIED FINANCIAL PLANNER® (CFP®) distinction.

Finally, see how well a potential advisor listens. If they can’t see past your investment portfolio to find out what’s important to you as a person, keep looking. A great next step is to give Curio Wealth a call.

So are financial advisors worth the money? With Curio Wealth, the answer is always yes, because we won’t charge if we can’t help.