At a certain age—usually somewhere in our fifties—retirement starts to get real. It’s no longer a vague, distant notion. Suddenly it’s a nuts-and-bolts reality. You start to wonder if you’ve put everything together correctly.

That anxiety mostly plays out in your investment portfolio. Investments are the main engine of financial independence in retirement. Are they ready to provide the support you’ll need?

The only way to optimize portfolio performance for this new chapter of life is to find the correct mix of investments for your situation. This ratio of stocks to bonds is called asset allocation, and it’s the simplest way to aim your portfolio toward your retirement goals.

Unfortunately, you’ll find lots of conflicting advice about asset allocation. Always keep a balanced portfolio, between 40% and 60% stocks, says one wealth management professional. Stick with a growth strategy, over 70% stocks, says another. Whatever you do, don’t rebalance your portfolio, says a third; after all, slow and steady wins the race.

If you ask us, all these perspectives hold pieces of the truth, but none has the monopoly. Asset allocation should change with your needs, and there’s room for multiple approaches over a lifetime of saving—especially when you’re closer to retirement than ever before.

Our recommended asset allocation strategy optimizes gains and manages risk through gradual rebalancing. It emphasizes different goals across the full retirement timeline.

We call this strategy the glide path, because it gradually descends from one primary goal to another, from wealth growth toward reliable income.

And while there’s no substitute for personalized guidance, here’s why the glide path is our general allocation recommendation for people in their fifties.

How The Glide Path Asset Allocation Strategy Works

FIrst, some allocation basics. Each type of investment has different characteristics:

- Stocks provide high returns but they’re risky. Between 1926 and 2021, portfolios made up of only (U.S.) stocks paid an average annual return of 12.3%1. They also lost money 25 out of those 96 years, and those losses could be significant.

- Bonds are less risky, but their returns aren’t as good. Bonds paid an average annual return of 6.3% over that 96-year study period. They also lost money in 20 of those years, though the heaviest losses were a fraction of the stock market’s.

These different characteristics allow you to better control the attributes of your portfolio. Increase your bond-to-stock ratio, and you boost stability at the cost of growth. Go heavy on stocks, and you increase your possible returns while taking on more risk.

That’s how asset allocation acts as your portfolio’s control panel, allowing you to calibrate growth versus risk and vice versa.

Allocating Assets for A Glide Path To Retirement

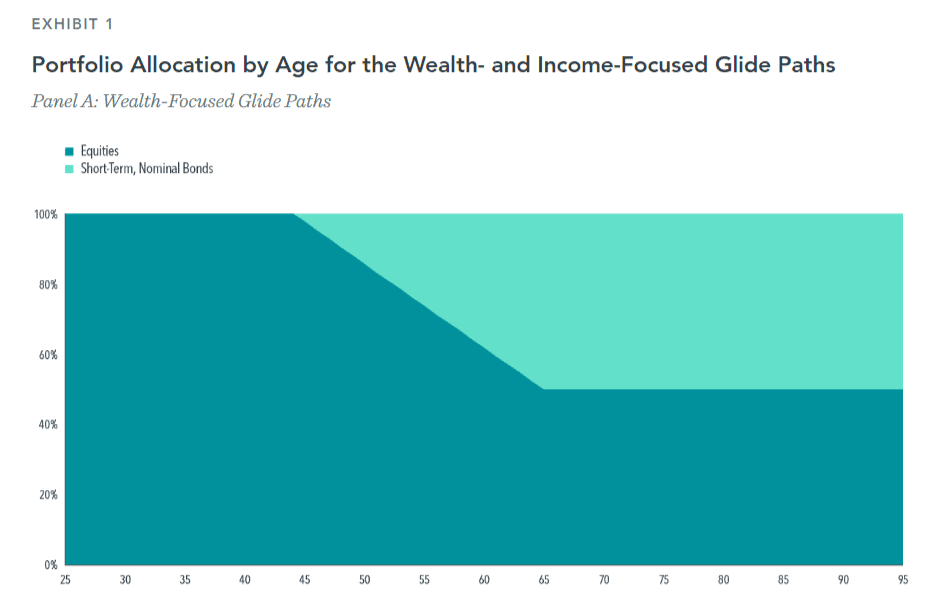

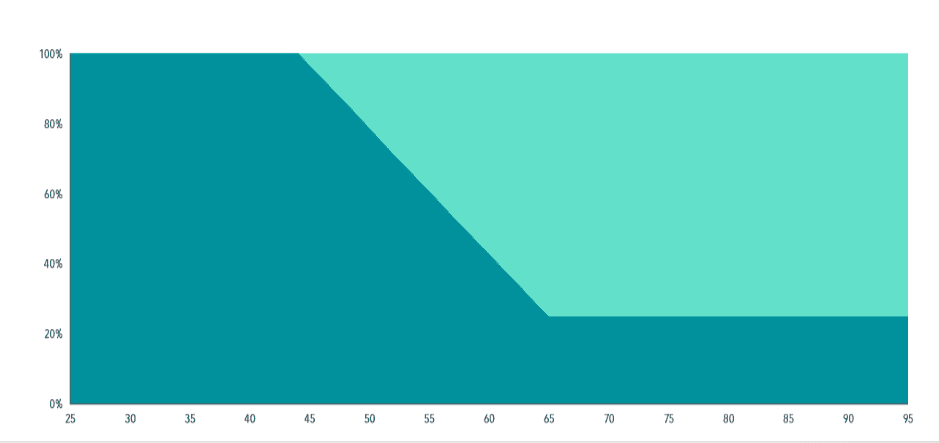

When you’re younger, you have more time to make up for market losses. You can afford more risk, so it’s wise to take advantage of higher-yielding assets. Typically, these conditions favor stock-heavy portfolios.

When you’re close to retirement, protecting what you’ve accumulated becomes more important than accumulating more. Pretty soon, you’ll be living off your nest egg’s returns. At that point, you can’t afford the kinds of large temporary losses that aggressive portfolios are exposed to. These conditions favor bond-heavy portfolios. (See boxed text for details on why this shift is so important.)

Sequence Of Returns Risk: Why You Want More Bonds In RetirementGenerally, the glide path steadily reduces your investments in stocks while increasing your bond investments. Why? In financial planning, we often deal in averages. We set goals for your annual average rate of return, for instance. For example, you might build your plan on the assumption that a balanced, 60-40 portfolio will get you a 6% rate of return on average. That might be accurate. But we don’t live on five-year averages in retirement. We live on the actual yearly rate of return. One year, your stock portfolio might be 14% up. The next, it might be 14% down. You could still get your 6% average over five or 10 years, but there are often lean intervals that can threaten the whole plan. This threat is called the sequence of returns risk. It becomes a real danger once you start living off your portfolio. And the way to guard against it is to shift into a more defensive stance, which we generally accomplish by trading out stocks for bonds. |

However, your stock portfolio doesn’t operate as a whole, unified thing. It’s made up of individual stocks, each of which may peak and plummet at different times. That means it’s extremely risky to rebalance your portfolio all at once. You can’t go from an aggressive, 80-20 stock-to-bond split to a conservative 60-40 portfolio overnight—not without leaving money on the table.

It’s far safer to make the transition from aggressive to balanced over a long time span, so you can buy low and sell high along the way. The glide path describes this gradual shift.

Hypothetical Wealth and Income Glide Paths by Mathieu Pellerin, PhD, Senior Researcher and Vice President at Dimensional.

Think about a commercial flight. The pilot doesn’t announce the plane’s “initial descent for landing” right above your destination. They might start a few states away, descending over miles and miles. It’s safer that way. A glide-path asset allocation strategy is the same—and that’s why we think it’s the best asset allocation strategy at any age.

Of course, the glide path is not the only model for asset allocation. Let’s zoom out to look at the concept of asset allocation from a broader perspective.

The 3 Types Of Asset Allocation Strategies

At the most general level, there are three categories of asset allocation in personal finance. Here they are, along with the glide path’s position in this broad organizational scheme:

- Static Allocation

This strategy strives for simplicity: Pick one ratio of stocks to bonds and stick with it throughout your saving years, it says. The ideal ratio of stocks to bonds is 60/40, you may decide, so why not go for that allocation right now?

The trouble with static allocation is that it doesn’t reflect the way goals change as you get closer to (and enter) retirement. If you’re particularly risk averse in your fifties, you might go for stability too early. That makes it hard to grow enough wealth to create your ideal retirement down the line.

At the other extreme, a static, growth-focused portfolio could expose you more to the sequence of returns risk in retirement. Portfolios must respond to particular needs, and needs change. That’s why static allocation is a risky choice.

- Dynamic Allocation

With dynamic allocation, you purposefully adjust your ratio of stocks to bonds over time. The glide path we recommend falls into this category.

We’ve already discussed the advantages of this approach, so what about the downsides? The challenge of dynamic allocation is that it requires careful planning and proper execution to get the most benefits.

- Reactive Allocation

Here’s the one to avoid. The classic investing mistake is chasing short-term gains. When investors fall into this trap, they might try to adjust their mix of stocks and bonds to meet whatever’s paying best, year by year. That’s the reactive asset allocation strategy.

It’s also called market timing, and it doesn’t work. Chasing returns out of fear is a losing strategy.

How To Execute Your Ideal Asset Allocation Strategy

Models like the glide path are helpful, but the truth is, the best asset allocation strategy is one that’s designed just for you.

At Curio Wealth, we specialize in bridging the gap between financial planning and life planning, focusing on the details for a custom solution.

We’ll work with you to identify goals. We’ll create a plan to meet those goals. Then we’ll help you execute that plan over the long term—and yes, that includes asset allocation.

At Curio Wealth, we can help you find the ideal asset allocation at every stage. We can help you build a glide path that ensures a secure, stable landing in retirement. Contact us for a free, no-strings-attached conversation about asset allocation or any of your wealth management goals.

1 Per Vanguard portfolio allocation models: https://investor.vanguard.com/investor-resources-education/education/model-portfolio-allocation. Indices are not available for direct investment. Their performance does not reflect the expenses associated with management of an actual portfolio. There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Actual returns may be lower.