As if another reminder was necessary, the financial markets have demonstrated once again that things can change dramatically in a very short period of time. After several months of relatively steady upward progress, culminating in an all-time high above 6,000 for the S&P 500 in mid-February, US equities have taken a bit of a dive. The roller coaster ride continued more recently, with the announcement of broad-ranging tariffs by the Trump administration, followed by a swift, retaliatory response from the Chinese government, heightened fears of a protracted global trade war, sending the S&P 500 down by a total of almost 600 points over a two-day period: a drop of more than 10%.

When market volatility reaches levels like these, it’s easy for investors to feel queasy about their portfolios. They may wonder if they should pull everything out and put everything in cash “until things settle down.” But is that really a good decision for long-term financial security?

When the market is behaving in extreme ways, investors can lose sight of the potential benefits of remaining invested for the long term. Watching investment prices in what seems like freefall makes it hard to remember the long-term strategies that may have been put in place when the portfolio was being constructed. But it’s important to remember that the occasional “downs” are the inherent flipside of the “ups” that investors hope to enjoy over the long haul. Decades of stock market returns demonstrate that price drops are to be expected. But historically, those declines have been followed by periods of recovery that eventually took the market to new highs.

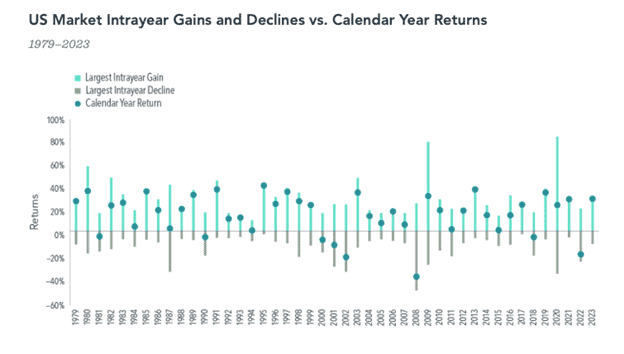

SOURCE: Dimensional Fund Advisors. Past performance is no guarantee of future results; indexes are not available for direct investment.

The chart above illustrates intrayear gains and losses and calendar year returns in US equities from 1979 to 2023. The average intra-year decline shown in the chart -14%. On the other hand, 37 of these 45 years have ended with positive returns. What this may indicate for investors is the importance of focusing more on the longer-term horizon than on short-term volatility.

There are other concerns that investors may be dealing with in the current environment that are focused on the potential economic implications of current US trade policy. Let’s consider some of the more prominent topics currently under discussion.

Will tariffs re-ignite inflation?

One of the concerns frequently expressed in connection with the imposition of tariffs is their potential for causing higher prices—as businesses pass the higher cost of acquiring goods on to their customers—and thus fueling higher inflation.

At this point, it is too early to tell with certainty what, if any effect the latest round of tariffs will have on core CPI. But even if inflation does increase, investors should probably avoid making drastic changes in their portfolios in an attempt to adjust to a more inflationary environment. Remember that the financial markets are constantly factoring in expectations about future inflation into asset prices. Because of this “forward-looking” orientation, the market is constantly re-setting prices at a level expected to compensate investors for the effects of inflation. In fact, long-run data demonstrate that stock and bond market segments have typically shown positive average investment returns even during periods of higher inflation. For this reason, it may not be necessary for investors to make drastic changes in their holdings to compensate for inflation.

Will we have “stagflation” because of tariffs?

At a certain point economists are just making words up, but this one has been around for a while, and there has been renewed concern lately about the possibility of “stagflation”: a period of rising inflation and economic contraction, including rising unemployment. Such periods have occurred about 12 times since 1930. In 9 of those 12 periods, the US stock market produced positive real returns (net growth after inflation). In fact, this rate of positive return, at 75%, is slightly higher than the frequency of positive real returns for the entire period 1930–2024 (with positive returns during 68% of the periods). Once again, the historical data may be telling us that concerns over the current economic outlook should not drive portfolio decisions. The market’s ability to factor all known data into current pricing argues for the wisdom of remaining invested, even during periods of uncertainty and volatility.

Managing Uncertainty

The central concern that underlies many of the questions above is our natural human dislike of uncertainty. None of us enjoys the feeling of not knowing for sure that our strategies and plans will work out the way we want them to. We often try to mitigate or avoid uncertainty, and in the investment arena, this can take the form of seeking safety by liquidating investments during periods of volatility, or “sitting on the sidelines,” as it is sometimes called.

But what we need to remember is that uncertainty is a fundamental ingredient in the risk/reward equation. There is a reason why the broad stock market has rewarded investors with an average return of 10% per year over the past century or so. Cash, on the other hand, while feeling safe – typically loses value the longer it is held, due to the effects of inflation. In other words, the only “certainty” achieved by holding cash may be the certainty of reduced buying power in future years.

The fact is that risk is a part of everyday life. But risk can, in many cases, be managed. The purpose of having a long-term financial strategy that is matched to your tolerance for risk and your long-term goals is to effectively manage risk in a way that can lead to the achievement of your goals.

What are your main concerns in the current financial and economic climate? It’s important that your financial strategy provide you with a way to manage these concerns effectively for long-term success. One strategy for dealing with your concerns is discussing them with your Curio advisor. Please contact us to let us know how we can help.