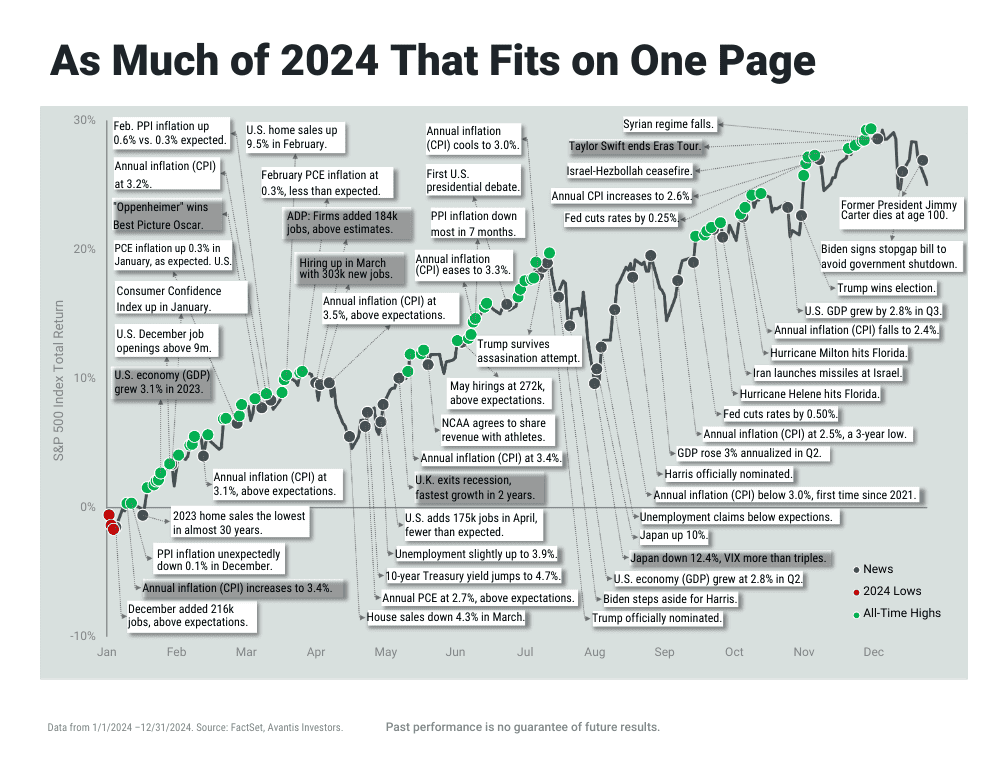

The financial markets are dynamic and unpredictable by nature, and they can be fascinating to watch. But how important are their gyrations to you, really?

Rather than zero in on the markets’ last few months (or how they might fare in the next few), take a step back and consider what truly matters: your personal goals and the life you want to create in 2025 and beyond.

Curio Wealth Quarterly Market Review for Q4 2024

A Few Thoughts on a Roaring Market

Two years of strong stock returns can lead to emotional responses—the flip side of the feeling you might get after a couple of down years. You probably know by now that it’s risky to sell in a panic when the market drops. But what about when the market just keeps going up?

On one hand, strong market performance can be exhilarating and inspire optimism about your future. On the other hand, it can create a kind of retroactive FOMO—a wish you had invested more aggressively so you could have made more money. You might even be tempted to invest more in stocks, so you don’t miss out if the bull run continues.

Don’t let the giddiness that can accompany a bull market throw you off. Your diversified, balanced portfolio is designed to help you achieve your goals by hitting an expected investment return while minimizing risk and smoothing out the ride. You will own the top performers but won’t have all your eggs in one basket. Being smart about where you save, how you withdraw from your portfolio, where you hold investments, and how you manage taxes will add value and help to increase returns.

Remember: Investing isn’t about chasing the biggest returns; it’s about maximizing your ability to achieve your life goals.

Returning to the Heart of the Matter

The core of your investment plan isn’t the markets, individual securities, or even returns. It’s you—your aspirations, values, and vision for the future. What do you hope to achieve in the years ahead? What brings meaning and fulfillment to your life? These are the questions that should guide your financial strategy.

The beginning of a new year is an ideal moment to refocus on these questions. We encourage you to take this time to reflect. Perhaps you’re looking forward to retirement and want to ensure you have what you need to live comfortably and pursue your passions. Maybe you’re thinking about your family and how you can best provide for their future. Or you might be contemplating trying new experiences that bring you joy, whether it’s taking that bucket-list trip, finally learning how to play the guitar, or volunteering at a local organization that means a lot to you.

The markets will undoubtedly have their ups and downs in the coming year. With a strong investment plan—including a well-diversified portfolio—your financial journey won’t be defined by those fluctuations. Instead, it will be shaped by the long-term goals you set and the steps you take to achieve them.

Navigating the complexities of financial markets and life goals can feel overwhelming. Using the best evidence available, we’re here to help shape a strategy that aligns your financial resources with your aspirations.

Let’s make 2025 a year of progress, purpose, and partnership.