The so-called “Magnificent Seven” stocks—Apple, Microsoft, Alphabet (parent of Google), Amazon, Nvidia, Meta (parent of Facebook and Instagram), and Tesla—have been getting a lot of ink (and pixels) in the financial news for the last few years. One of the reasons is because their capitalization is so large ($12.3 trillion as of the end of 2023, according to Bloomberg) that they make up an oversized percentage of their indexes, especially the S&P 500. Remember that the S&P 500 is weighted by market capitalization, which means that companies with larger market capitalizations have a greater effect on the direction of the index than other companies. And for perspective, the capitalization of the “Magnificent Seven” roughly equals the entire capitalization of the stock markets of Japan, Canada, and the UK, combined. When these stocks are rising, they tend to drag their indexes along with them. Of course, the opposite is also true: bad news for the Mag 7 is typically also bad news for their indexes. As the Kikuyu people of Kenya say, “When elephants fight, the grass suffers.”

But for the last couple of years, these “elephants” have been throwing their weight in positive directions, for the most part. In 2023, these seven stocks returned 111%, on average. Through the first quarter of 2024, Microsoft, Amazon, Nvidia, Meta, and Alphabet rose 12%, 82%, 19%, 37%, and 8%, respectively, while Apple and Tesla were down for the quarter (11% and 29%, respectively). In 2023, all the companies’ earnings beat analysts’ expectations, which mostly accounts for their impressive price performance.

Will the Mag 7 continue to outperform during 2024? Or will their earnings trend closer to analysts’ forecasts? If the former, we could continue to see the kind of stellar numbers that they posted in 2023. But if the latter is true, or if, as in the case of Apple and Tesla for the first quarter, earnings projections soften even more, these stocks could exert a drag on the equity indexes. And as investors know, past performance is no guarantee of future results, and it’s impossible to predict short-term price movements with better than random accuracy.

Diversification Matters

All of which brings us to the ongoing importance of diversification for long-term investors. While it certainly makes sense for some portfolios—particularly those focused on growth—to have some exposure to the Mag 7 and similar assets, it is unwise to place too many eggs in the Mag 7 “basket.” There is no investment that is risk-free, and nothing goes up forever. But by creating a well-diversified portfolio with a mix of different asset types, it is possible to reduce the amount of risk posed by the poor performance of any single investment.

Further, for many investors, diversification should also include global markets. In other words, it is often wise to think beyond the borders of the US financial markets when seeking to diversify. In fact, when conditions occur that create problems for the Mag 7—and, by extension, for the S&P 500 and other US indexes—global diversification can offer some protection for the total value of the portfolio.

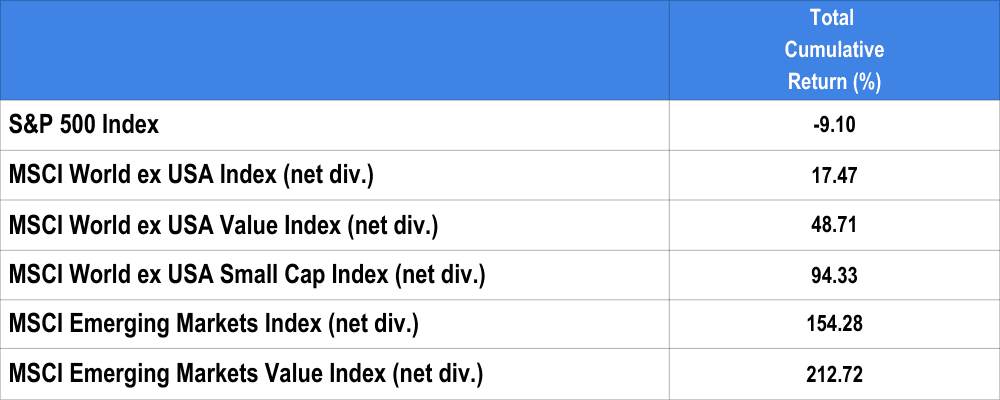

It’s important to remember that some 46% of equity investment opportunities are comprised by non-US markets—nearly half of the world’s market capitalization. Investors who are prepared to take advantage of this fact can benefit from both diversification and growth opportunities that are unavailable when all investments are confined to the domestic markets. A good example of these opportunities is the “lost decade” from 2000 to 2009, when the S&P 500 had one of its poorest performance periods. Meanwhile, many global markets were experiencing growth, as illustrated by the following chart:

Global Index Returns Compared to S&P 500, January 2000 – December 2009

SOURCE: Dimensional Fund Investors. Past performance is no guarantee if future results; indexes are not available for direct investment.

David Booth, Founder and Chairman of Dimensional Fund Investors, states that global diversification can help investors avoid “extreme investment outcomes,” especially when they are committed to staying the course over the long term.

Sticking to the Plan

Which brings us to a final, and very important point. No investment strategy will yield its true value to the investor unless there is commitment. This is why your portfolio should be designed with careful consideration of your individual goals, resources, and tolerance for risk. When a portfolio is founded upon these elements, and when it incorporates broad and appropriate diversification, it is vital for the investor to remain committed to the strategy and not become distracted by short-term market developments that either excite greed (as in, “I want to go all-in on Amazon!) or fear (as in, “The market is falling; I want to sell everything!”). Decisions driven by either of these emotions will rarely, if ever, be of long-term benefit to the value of the investor’s portfolio and will almost never contribute meaningfully to the achievement of important long-term goals.

At Curio, we believe that the most important service we can provide is learning as much as we can about each client, so that we can help them design strategies and portfolios that capture value, consistent with the client’s goals and tolerance for risk. That is why we ask questions: we want to know what matters most to our clients, because that tells us what matters most for their financial plans and goals. If this approach appeals to you, why not visit our website and tell us your story? We’d love to learn more!