GET IN TOUCH

Want to Learn More?

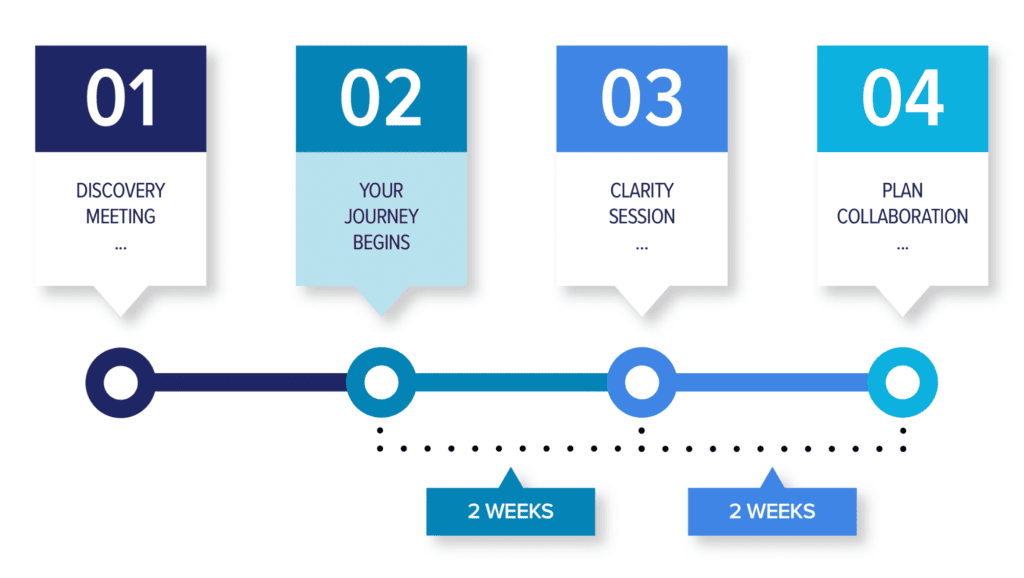

We’re excited to engage with you whether you’re curious about a particular topic or eager to explore how our approach can be personalized to suit your needs. Feel free to ask any questions or dive deeper into what we can offer.