Considering whether to sell or hold a stock or property that’s gone up in value? If you choose to sell, your decision could have tax implications. This is why tax planning is critical, it can have a major impact on your family’s wealth. While you don’t need to be a tax professional (we’ll handle that), it’s helpful to understand the difference between two tax-related concepts: a realized gain vs. unrealized gain. The former occurs when you sell an appreciated asset, and the latter occurs when you hold it.

In this article, we’ll dive deeper into both concepts, and how to manage each type of gain. we’ll also share real-world tax planning examples from our clients at Curio Wealth.

What is a realized gain?

Simply put, a realized gain occurs when you sell an asset that has appreciated in value, for example, a property that you own. The gain itself is the difference between what you sold the asset for and what you initially paid for it, the latter of which is known as “cost basis.”

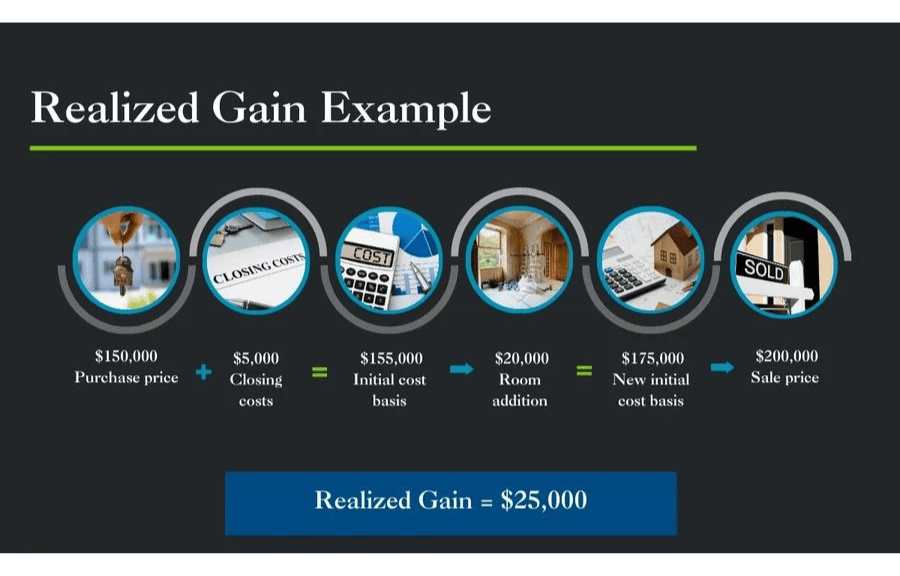

let’s walk through the process with an example.

In this simplified illustration, imagine that you bought an investment property for $150,000 and $5,000 in closing expenses. Your initial cost basis would be $155,000. A year later, you decided to add on a room to the house, which cost $20,000. That home improvement would also be added to your cost basis and would bump it up to $175,000. If you sold the house the following year for $200,000, your realized gain would be $25,000.

A realized gain can also occur in your investment portfolio when you sell a security that has appreciated in value, such as a mutual fund, exchange traded fund, or a bond. It can also apply in a corporate setting (think patents, copyrights, goodwill, and certain equipment), but for the purposes of this article, we’re going to stay focused on personal finances.

What is an unrealized gain?

An unrealized gain occurs when you’ve bought something that has appreciated in value, but you haven’t yet sold it. The difference between the cost basis and what you could sell the item for is the unrealized gain.

Realized Gain Vs. Unrealized Gain

We like to think about the difference between a realized gain vs. unrealized gain as kinetic vs. potential energy. A realized gain is the former, the energy has gone into motion, and now you have tax implications to face. An unrealized gain is the latter, the energy is stored up; it has accumulated and hasn’t yet gone into motion.

it’s important to note that in day-to-day life for most people, unrealized gains generally only apply to capital assets that you have a reasonable expectation will increase in value over time, like a stock or a property you own. This is because not all assets will increase in value.

For example, if you buy a stand mixer for your kitchen, use it, and sell it at a yard sale, it doesn’t matter if you sell it for more or less than you bought it for. You can’t claim it as a tax loss if you sold it for less, and you don’t need to report it as a gain if you sold it for more, so you don’t need to track its value over time.

Why should you claim a realized gain on your tax return?

First and foremost, all Americans have to take certain actions for tax purposes to stay compliant with tax law. Aside from that, the main advantage of claiming a realized gain (or recognizing the gain) is that long-term capital gains are taxed at a lower rate than ordinary income.

So, if you buy an investment and hold it for a year or longer, you’ll get the benefit of long term capital gains tax treatment when you sell it and claim a realized gain. The federal capital gain rates are 0%, 15%, and 20% (and collectible items have a special 28% rate), and the one that will apply to you depends on your total taxable income and filing status.

In case you missed it, let’s reiterate that if your tax situation allows, the capital gains rate can be as low as 0%. that’s a tremendous advantage. However, keep in mind that if you sell that same investment before you’ve held it for a year, it will be classified as a short-term gain and taxed at your ordinary income tax rate.

There are times that you may intentionally trigger realized gains. For example, if you’re rebalancing your portfolio and you want to maintain a certain mix of investments, you’ll need to sell those that have appreciated in order to do so.

it’s critical to be intentional in planning when you sell these investments, ideally, when you can fall into a lower tax bracket. Make sure it’s a long-term gain if possible and try to get it in the 0% gain bracket, which is applicable if your income is $89,250 or less as a married couple filing jointly, or $44,625 or less as a single filer. Your financial advisor can help you with all of these aspects of tax planning.

How should you record an unrealized gain?

Since unrealized gains aren’t claimed as part of your taxes, you may be wondering what, if anything, you need to do to keep track of these gains.

let’s look at securities as an example. Depending on where you hold them, the shares you own are likely to be “covered,” which means the cost basis is being tracked by the custodian. Up until 2011 for company stocks and 2012 for mutual funds, you often had to track this information yourself. Now, it’s taken care of for you.

Unlike securities, however, you do need to track financial information related to investment properties. The best thing to do is to track your cost basis over time, i.e., the money you’re putting into the property.

Understanding Your Tax Implications

At Curio Wealth, we can help you understand the potential tax implications of your family’s unique financial circumstances. We take an integrated approach to taxes, investments, and financial planning to enable you to see the big picture all at once. Ready to get started? Schedule a call with our team.