If you’ve been feeling a financial pinch lately, you’re in good company. Inflation, or the rising cost of consumer goods and services, spiked in the U.S. in 2022 at 9.1%, but is stubbornly hanging on this year at a rate significantly higher than its long term average. This has left many Americans wondering how to adjust for inflation when it comes to their spending.

In this article, we’ll explore what causes inflation and why it’s such an issue right now. Then, we’ll offer five tips on adjusting your budget for inflation to keep your finances out of the red.

What causes inflation?

Many factors can contribute to an inflationary environment. For example, in a thriving economy, wages tend to increase. As wages go up, businesses selling goods and services tend to raise their prices, but on the flip side, they also need to pay more for labor. You can see how in this situation, wage pressure can contribute to demand-driven inflation.

Supply chain disruptions like those that occurred during the pandemic can also put inflation into overdrive. When goods and services are in demand but there isn’t enough supply to meet that demand, prices naturally go up. Remember the toilet paper debacle? that’s a perfect example.

In addition, institutional policies can be implemented with the intent of causing inflation to start ticking upward. During the pandemic, the Federal Reserve started Û÷printing more money’ (increasing money supply through various mechanisms). With an influx in cash flowing through the economy, and prevailing interest rates at record lows, consumers could suddenly afford to pay more for goods and services, or choose to spend their money on discretionary purchases. (You know that neighbor who bought a hot tub during lockdown? That’s exactly what we mean.)

Why is inflation such an issue right now?

Inflation is a thorn in the sides of Americans right now because it’s much higher than usual. Since the government began measuring inflation in the 1920s, and depending on the data used, it has historically stood at about 3% per year. that’s the figure we use in our financial planning at Curio Wealth. For the past two decades, inflation has been below average. That changed drastically in the wake of the pandemic.

Most recently, the prevailing concerns around inflation have been the risk of a “wage-price spiral” situation. The country experienced a supply chain shock (decrease in supply), while simultaneously experiencing an increase in demand (see money printing above), and an historically strong labor market. This created the potential for a loop, or spiral, in which costs rise due to the lack of supply; then wages rise, and costs go up even further and the cycle could repeat itself until inflation becomes uncontrollable.

The Federal Reserve plays a role as America’s central bank to try to fight inflation at a broad level. The Federal Reserve has taken critical measures to try to contain inflation (preventing wage-price spiral) with the tools it has available, such as raising the federal funds interest rate and reorienting its strategy of quantitative easing. Adjustments the central bank makes to its rate trickle out to the broader economy the aim being to get inflation under control.

Understanding Your Inflation Rate

When considering how to adjust for inflation, it’s important to note that every individual’s inflation rate is different. This is because everyone’s “basket” of preferred goods and services is composed of different items. Your geographic location also plays a role, with some U.S. cities being notoriously more expensive than others. (Here’s looking at you, Manhattan and San Francisco!)

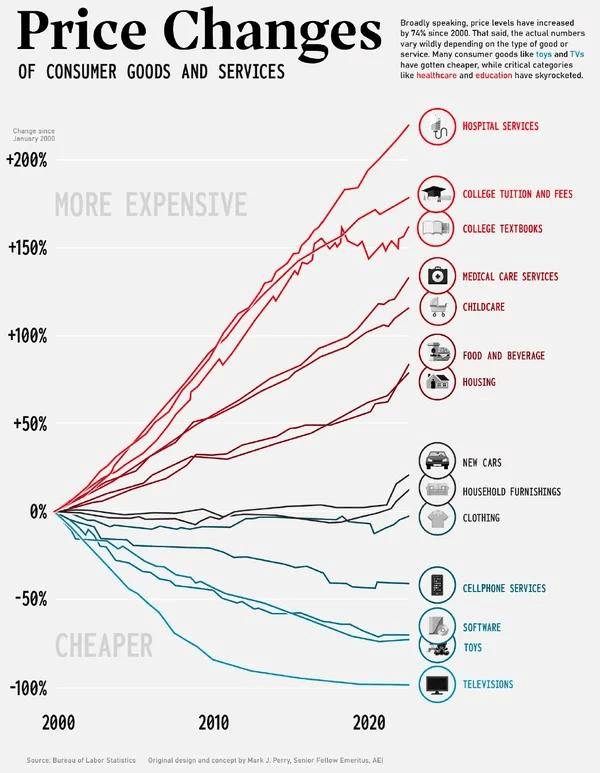

The Bureau of Labor Stats tracks various goods and services for different rates of inflation. Certain items in the graphic below have sharply increased in cost over the past few years, while others have stayed relatively flat, or even decreased.

The point: Some people may feel the effects of inflation much more quickly or dramatically than others. So, stay attuned to where and how you’re feeling the effects. The grocery store and gas pump are common culprits these days, as prices have sustained above their normal fluctuating levels. All Americans are experiencing that pain.

How Inflation Affects Your Finances

It’s good to have a basic understanding of inflation, but how does that affect you specifically? At Curio Wealth, we’re all about helping you see the big picture. So, let’s review two major financial areas that inflation can impact: your investments and your mortgage.

Making Investment Decisions

it’s critical to draw the distinction between short- and long-term investment decisions.

In the short term, whether or not inflation is high it’s key to avoid making any reactive investment decisions. If inflation is higher than average at a given time, that unfortunately doesn’t offer any predictive information about stock or bond prices.

For example, it looked like inflation was ratcheting up at the beginning of 2022, but it was unclear whether it was here to stay, or if it was temporary. Inflation has stuck around, but there was no way to know that in advance, or to be certain that interest rates would increase as they have.

In the long term, inflation is your investment portfolio’s enemy and your portfolio must be positioned to withstand it. For most investors, it’s important to maintain an allocation of investments with a probability of growth that gives you a reasonable chance of outpacing inflation. That’s where stock ownership comes into play. On the bond side, high inflation hurts bond prices. This means you must be prepared to withstand that, so you need diversification in your portfolio.

Grappling With Mortgage And Rent Rates

When it comes to mortgage rates, consumers can quickly feel changes in the prevailing interest rates. Mortgage rates are also influenced by the supply and demand of housing and mortgage-backed securities. However, recent interest rate increases by the central bank have bumped up mortgage rates at a rapid pace. This cost has also been passed down to tenants.

The current housing situation, and cost of housing in America is unique to this period of time. Many people hope to see some softening in the real estate markets, but the supply shortage the country has been facing since the Great Recession continues to be a persistent constraint on downward pressure for prices. Despite the fact that housing costs have gone up, demand hasn’t softened.

How To Adjust Your Budget For Inflation

An average annual inflation rate of 3% means that your basket of goods and services will double in cost every 24 years. This is why financial planning is essential. Additionally, the time frame may even be shorter than 24 years due to high inflationary periods like the one we’re in right now.

Navigating inflation and protecting purchasing power over time has always been one of our greatest financial challenges as a society. Here are a few tips to help you adjust your budget for inflation and maintain your family’s financial health:

1. Know Your Numbers

You can’t make adjustments to your finances if you don’t know where you stand right now. Track and measure your expenses today, and what they were over the past several months. You can use software or a spreadsheet. The key is to figure out what works for you and get the initial data that you can measure against.

2. Look For Substitutions

let’s say you’ve tracked your expenses and know your habits, and you’ve been buying a bag of chips that used to cost $2 but now costs $4. that’s a big jump. The difference is much greater than the average rate of inflation.

When it comes to decisions about the goods and services you’re buying (especially those that have inflated in price), it’s natural to begin making these kinds of decisions at the point of purchase. Perhaps you bought name brand chips before, but you decide to buy the grocery store brand going forward.

3. Remove Discretionary Items

Sometimes you simply have to cut luxury or discretionary items from your budget. Think about what you can live without. Maybe you start going out for dinner once a month as opposed to once a week, or you rent a movie instead of seeing one at the theater.

4. Watch Your Wages

Keep an eye on your wages, because when inflation is up 6% but salaries are only up 3%, that means you’re getting paid less. it’s important to look out for yourself and collect a wage that will help make sure you can maintain your standard of living.

See what ability you may have to increase your wages, whether that includes negotiating for a performance-based wage, comparing your wage to your industry as a whole and reporting back to your boss, or having a voice at the negotiating table when a cost of living increase doesn’t come through at the level that it needs to (or at all).

5. Review Your Cash Reserve

You likely have a cash buffer in your bank account to get you through a rainy day, but you might need to tap into it more frequently when your expenses increase. Review your cash reserve often to make sure you’re not overspending.

Need help navigating the fog of inflation?

You don’t have to figure out how to adjust for inflation on your own. At Curio Wealth, we can help you navigate your financial situation by looking at it from a 30,000-foot view. By taking a big picture approach to your financial plan, we can help make sure you’re prepared at all times for inevitable bumps in the road, including those that may affect your investment portfolio in the short and long term. If you’re looking for some financial guidance, schedule a call with us today.