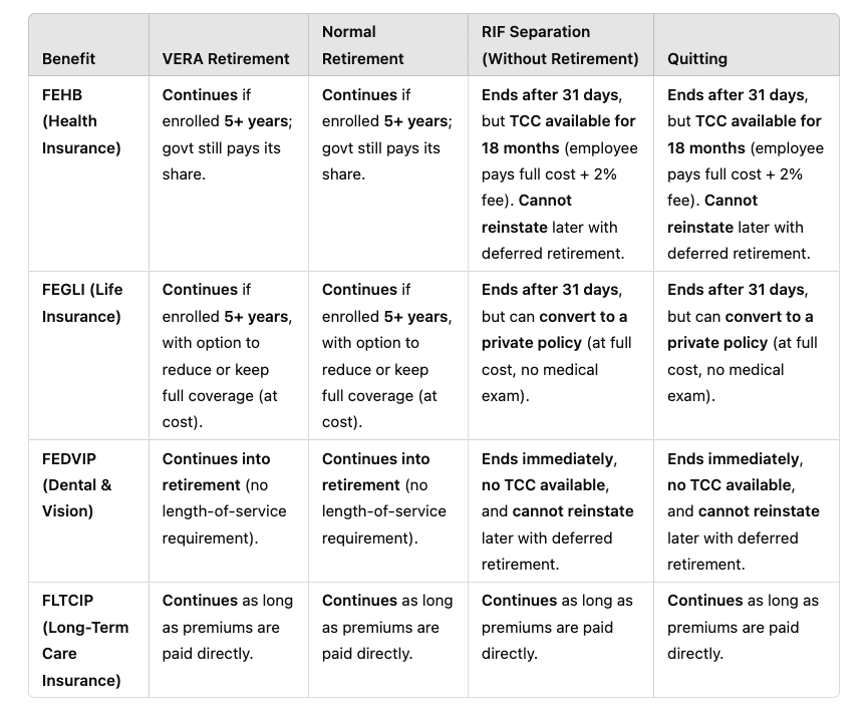

FEHB

(Health Insurance) | Continues if enrolled 5+ years; govt still pays its share. | Continues if enrolled 5+ years; govt still pays its share. | Ends after 31 days, but TCC available for 18 months (employee pays full cost + 2% fee). Cannot reinstate later with deferred retirement. | Ends after 31 days, but TCC available for 18 months (employee pays full cost + 2% fee). Cannot reinstate later with deferred retirement. |

| FEGLI (Life Insurance) | Continues if enrolled 5+ years, with option to reduce or keep full coverage (at cost). | Continues if enrolled 5+ years, with option to reduce or keep full coverage (at cost). | Ends after 31 days, but can convert to a private policy (at full cost, no medical exam). | Ends after 31 days, but can convert to a private policy (at full cost, no medical exam). |

FEDVIP

(Dental & Vision) | Continues into retirement (no length-of-service requirement). | Continues into retirement (no length-of-service requirement). | Ends immediately, no TCC available, and cannot reinstate later with deferred retirement. | Ends immediately, no TCC available, and cannot reinstate later with deferred retirement. |

FLTCIP

(Long-Term

Care

Insurance) | Continues as long as premiums are paid directly. | Continues as long as premiums are paid directly. | Continues as long as premiums are paid directly. | Continues as long as premiums are paid directly. |