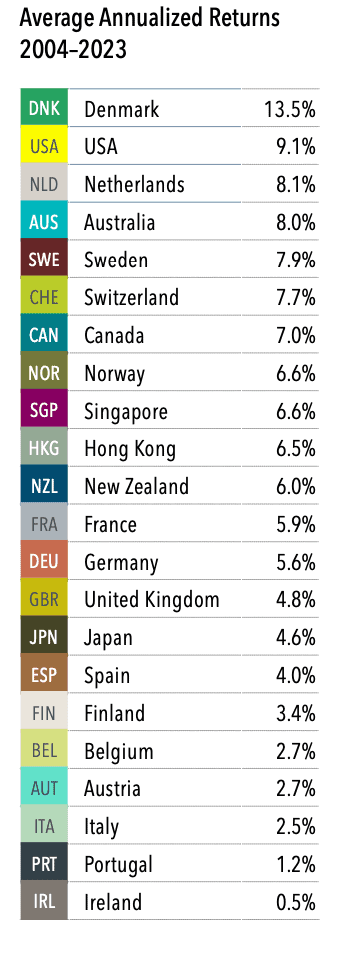

If I offered you three chances to guess which nation’s stock market had the highest average rate of return over the past two decades, what would you say? Like many, you might be inclined to think about the US market (which has been pretty solid the last couple of years, especially) or one of the other developed markets like Germany or Japan. But I wonder if you would guess the right country—Denmark. That’s right: little Denmark, with a population less than 2% the size of the US, had average annualized returns of 13.4% from 2004 to 2023 (the US came in second, at 9.1%).

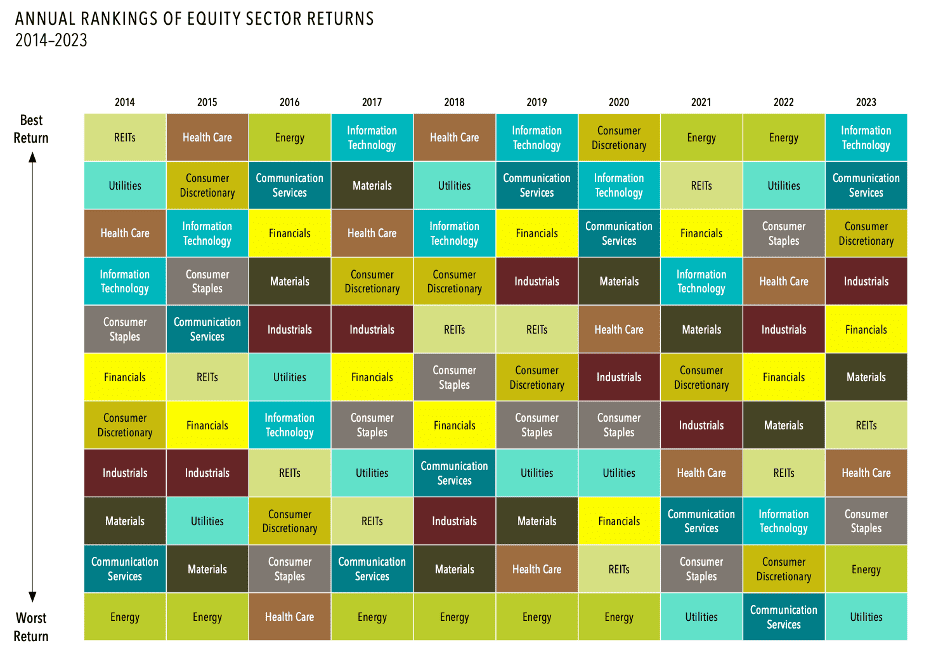

Now let’s take a different angle. What if I asked you to guess which industry sectors had the best returns for the last ten years? You might be inclined to guess information technology, because, after all, the “big tech” stocks have been dominating the US markets for several years. But in reality, the information technology sector has led the pack in only three out of the last ten years (2017, 2019, and 2023).

So, what’s the average investor to do? If it’s impossible to tell which sector, or even which country, is going to have the best performance in a given year, how is it possible to capture better returns in the portfolio?

A big part of the answer is diversification. Because it is virtually impossible to pick the winner—or even the top three or four winners—during any given timeframe, the best solution for most investors is to diversify as broadly as possible: among sectors, among countries, and certainly among asset types. By owning a portfolio as broadly diversified as possible, most investors are able to capture gains from those areas that are doing well in any given year, thereby helping to offset losses occurring in other areas at the same time.

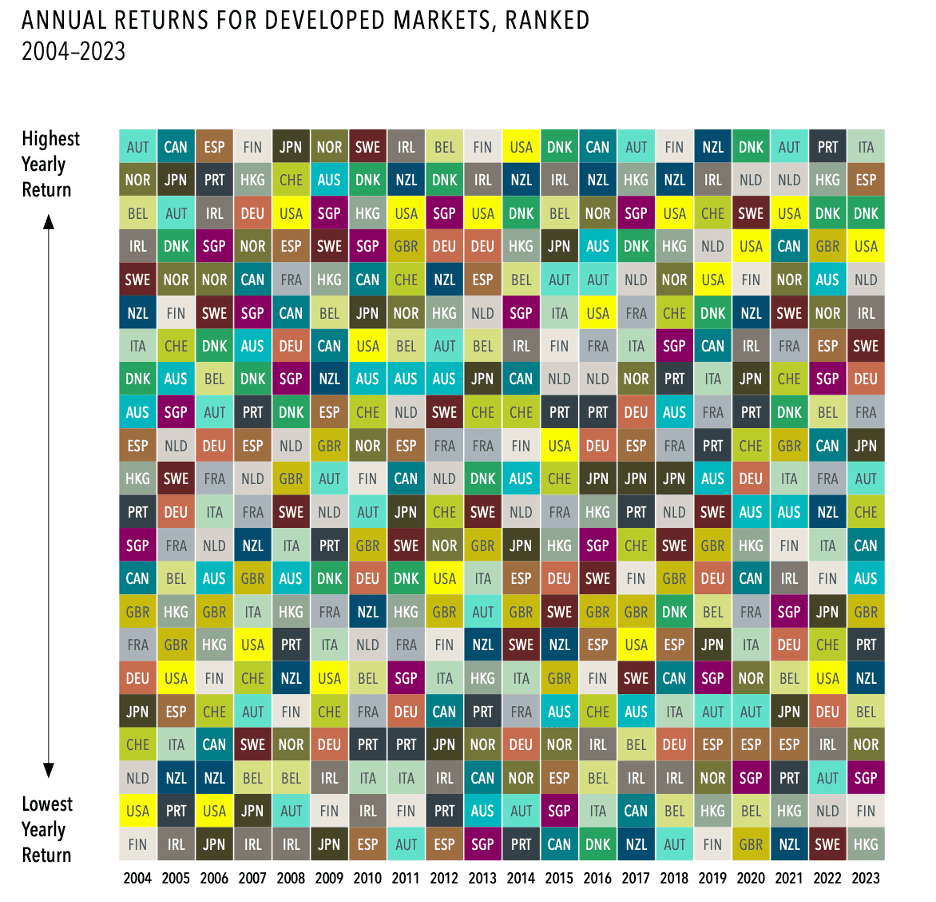

To get a sense of how random performance can be, consider the following chart, illustrating the rate of return achieved by the stock markets of various developed markets around the world:

SOURCE: Dimensional Fund Advisors. Past returns do not guarantee future results; indexes are not available for direct investment.

Keep in mind that by “developed markets,” we mean those in countries with a sophisticated economy, advanced financial markets, and a stable political system. Here is a listing of the countries in the chart above, with their average annualized returns over the past 20 years:

SOURCE: Dimensional Fund Advisors. Past returns do not guarantee future results; indexes are not available for direct investment.

Looking at the distribution of the different countries in the first chart, how difficult do you think it would be to anticipate the top performer in any particular year? This may begin to offer some perspective on why it is usually counterproductive to try and outguess the market. Rather than doing so, it may make sense to create a portfolio that is well diversified among holdings represented by different countries. Remember, the US equities market, though the largest in the world, only represents about 60% of the companies available for investment. In other words, one way investors can create greater diversification in their portfolios is by looking beyond the borders of the United States to opportunities available internationally.

But suppose, rather than thinking in terms of countries, we think in terms of industry sectors. Take a look at the following chart, which ranks various industry sectors by their investment performance during each of the last ten years:

SOURCE: Dimensional Fund Advisors. Past returns do not guarantee future results; indexes are not available for direct investment.

Once again, it’s hard to find a reliable pattern. In fact, no single industry sector has consistently outperformed during the last ten years, even if we consider the entire universe of international equities, as shown in the chart above. For many investors, then, a better approach might be to diversify across as many sectors as possible, allowing participation in those sectors with superior returns to provide a cushion for those which may be underperforming at the same time.

How to Diversify

It isn’t necessary to purchase every stock offered by every company in every country. In fact, attempting to do so would be impractical, if not impossible. It is possible, however, to own shares in mutual funds that represent international and sector diversification. By choosing funds that match the investor’s asset allocation and risk profile, it is possible for many investors to achieve effective diversification of holdings in a way that “casts a broad net,” positioning the portfolio to benefit from expected returns across a broad range of assets with differing characteristics.

What is your approach to diversification? Have you considered international equities as part of your diversification plan? Does your investment strategy accurately reflect your most important goals and intentions? If you would like more information on diversification, international equities, or any other important financial topic, please contact your Curio advisor today.