Are you losing sleep over your investments? Implementing a portfolio rebalancing strategy is an excellent way to give yourself some peace of mind (and a few more hours of shut-eye every night). In this article, we’ll outline three signs that indicate you should rebalance your portfolio, while keeping emotions out of the equation. we’ll also answer the question, “How often should you rebalance your portfolio?” and explore what the process entails.

Why is portfolio rebalancing important?

The Greek philosopher Heraclitus said, “The only constant in life is change.” The same holds true for the stock market. As market conditions evolve, your investment portfolio will look different at various points in the year. Portfolio rebalancing is an excellent way to help make sure your investment allocation remains within your risk tolerance level. This tactic also helps you sell high and buy low to maximize your wealth.

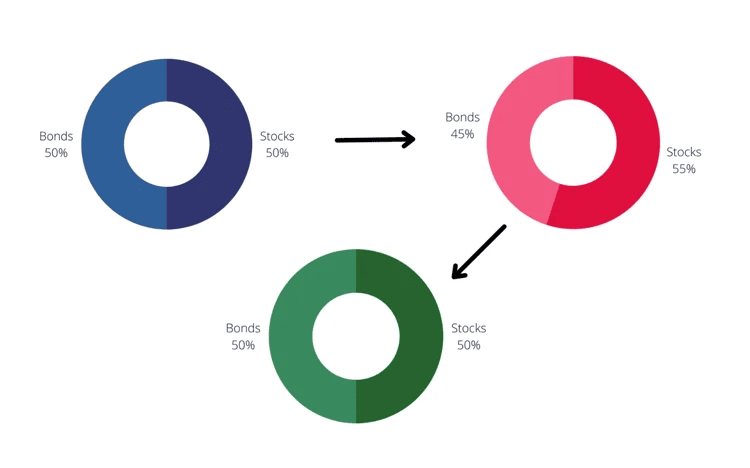

For example, if you invest 50% of your portfolio in the stock market and the other 50% in bonds, then stocks go up by 10%, your portfolio will be out of balance and no longer contain a 50/50 split. Instead, you’ll now have 55% exposure to the stock market, and your portfolio will be invested in a more aggressive manner than it was before.

In this case, if you had a rebalancing philosophy to follow, it would guide your next move: Seize the opportunity to sell 5% of your stocks at a high price, rebalance your portfolio (since you only need 50% invested in the stock market) and buy into safer assets to take some risk off the table.

People tend to invest with their emotions and can have trouble selling investments when the market is going up. In contrast, they often want to sell when the market is down. Following a rebalancing strategy will help take some of the emotions out of investing by providing specific buy and sell guidelines that can have you selling high and buying low.

How often should you rebalance your portfolio?

You should typically rebalance your portfolio every quarter to every six months. Here are three specific signs to watch for that indicate you should rebalance.

1. When the market goes up or down.

You likely remember that the stock market took a nosedive when the COVID-19 pandemic hit. At Curio Wealth, our rebalancing strategy at that time involved encouraging our clients to use this opportunity to buy stocks at a lower price, not because we were trying to time the market, but because the equity portion of the portfolio went down and our rebalancing strategy suggested we buy. This effort took a strong stomach to implement. If you did not have cash to use to purchase equities, it required selling safer, fixed income (bonds) and buying riskier equities (stocks). The key in situations like this is to avoid slipping into panic mode and stick to your strategy.

2. When you receive (or spend) a large sum of money.

If you suddenly come into extra money such as an inheritance or a large bonus, you can use these funds to rebalance your portfolio. This is often ideal as it will allow you to rebalance without having to sell stocks and recognize taxable gains. Similarly, if you need to take money out of your investments, this is also an opportunity for portfolio rebalancing.

3. When you experience a big life change.

Milestones in life like buying a home, having a child, or entering retirement often signal that it’s a good idea to rebalance your portfolio because your income, as well as your financial needs, may have changed.

| Pro Tip: Even if your portfolio contains only stocks, you’ll still want to consider rebalancing it from time to time. A diversified portfolio should include various asset classes, such as large and small cap stocks. These asset classes perform differently, so you should occasionally adjust the amount of each within your portfolio. Returning to the example of the pandemic, large cap technology stocks performed well during this time, while small cap stocks didn’t fare as positively. We sold the higher performers and purchased the lower performers as part of our rebalancing strategy. |

What does portfolio rebalancing entail?

it’s good practice to review your portfolio on a quarterly basis. Today’s technology is advanced enough that you can monitor it daily; however, you don’t want to do it so often that you’re creating transaction costs or taxes.

Instead, you could decide to rebalance based on whether a specific asset class goes up or down by at least 5 to 20%. Setting these kinds of parameters holds you accountable to analytics rather than emotion. That being said, remember to contact your financial advisor any time you experience a major event in your life that could change your financial situation.

You always want to take taxes into consideration. Recognizing big gains could be a reason to hold off or sell investments that you hold in a tax deferred account such as an individual retirement account (IRA), or a tax-free account such as a Roth IRA.

Investment And Tax Advice, Combined

At Curio Wealth, we understand that your investments can impact your tax bill for better or worse. we’ll structure your portfolio in a way that keeps your taxes as low as possible, and your returns robust. we’ll also make sure your investment strategy is aligned with your family’s financial goals. Interested in learning more about our approach to investing? Schedule a call with us today.